Sometimes it’s hard to look beyond the immediate volatility.

Even this morning, as crude prices trade 2% lower, it’s hard to find the silver lining for several reasons… whether it’s a flood of Iranian supply poised to hit the market, or the Saudis making one last desperate cash grab through their new IPO, or even the millions of gallons of U.S. crude that will be loaded into tanker hulls in the Gulf of Mexico this year.

To quote a friend, “The sky is falling.”

That has also been the sentiment that has been dominating headlines since crude prices broke the $30/bbl threshold recently.

Or as the International Energy Agency put it: the world is at risk of drowning in oil. That’s the conclusion the IEA drew after trimming its estimates on non-OPEC supply this year by 600,000 barrels per day and slashing global demand estimates.

That doesn’t sound too bleak for oil bulls, does it? If not, then it’s best not to remember another development that’s looming around the corner…

The Iran Factor

If the Saudis felt threatened by drillers in the U.S. tapping into their tight oil resources, then OPEC’s largest producer should be scared to death of sanctions being lifted on Iran.

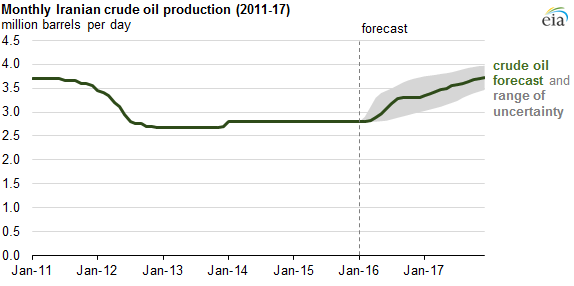

After sanctions were imposed in 2012, Iran’s crude exports dropped to around a million barrels per day. With those sanctions lifted, the country is expected to boost its oil output by 500,000 barrels per day in the near future.

If all goes well, production could reach upwards of 4 million barrels per day:

I also can’t help but think an extra $100 billion or so that is freed up for Iran will come in handy.

Well, so much for King Salman’s precious market share. Maybe there’s a little more to the ongoing spat between Saudi Arabia and Iran than an execution?

I’ll leave the speculations to you.

Of course, the promise of more Iranian crude will shift the battlefield from the tight oil plays in the U.S. (where drilling activity has plummeted since the Saudis started their price war) to the Mediterranean, where it will directly go up against the world’s largest oil producers: Saudi Arabia, Iraq, and Russia.

That may not bode well for a recovery… but are we really that worried?

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Worried About Another Crash?

Last week, I had some choice words for one of my colleagues over the future of his oil investments.

My sentiment hasn’t changed in the slightest.

Time and again, we’ve laid out the case for you regarding the hole that OPEC — and the Saudis in particular — has dug for itself since the decision to defend low oil prices in November of 2014.

Remember, many of the oil cartel’s members need higher oil prices to keep their budgets above water. Yes, even the Saudis can’t weather this low price environment indefinitely — not if the House of Saud wants to maintain its lavish social welfare programs, at least.

And not everyone is as well off as the Saudi kingdom.

Perhaps the hardest hit is Venezuela, whose economy is teetering on the edge of collapse. Forget growth, dear reader — the Venezuelan government (which depends on oil for 96% of its export revenues and nearly half of its spending) has lost upwards of $50 billion due to sub-$30/bbl oil.

Not enough doom and gloom for you?

Now add another half a million barrels of oil supply from Iranian fields, as well as the estimated 50 million barrels of crude collecting dust in 25 Iranian tankers (aptly labeled “very large crude carriers”) offshore.

Could we see a barrel of oil hit $25? I don’t think you’ll find anyone that doesn’t think it’s at least possible.

Given the state of global supply, oil prices aren’t going to recover overnight; if nothing else, you can count on that fact.

What you WILL see, however, is a hell of a lot of value lying around while the blood flows freely in the streets.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.